Section 1: Security

A reimagined economy must be grounded first and foremost in the value of security. We define security as the ability to meet one’s economic needs sustainably and to endure periods of instability. An economy that rests on the principle of security ensures that Americans can cover their food and housing needs and have access to affordable health care, education, and childcare. A secure economy is one in which people can afford these basic goods and services because social safety nets help ensure that everyone achieves a certain degree of sufficiency. Finally, an economy that values security provides Americans with enough support to be able to weather economic shocks—both personal shocks, such as a job loss or an illness, and societal shocks, like a pandemic or recession.

Security allows Americans to meet their basic financial needs and it enables them to flourish as human beings. In his 1944 State of the Union Address, President Franklin Delano Roosevelt made a declaration that remains apt today: “True individual freedom cannot exist without economic security and independence.”36 Many Americans today understand that a lack of economic security inhibits their personal freedom. As we heard from listening session participants, having to work two or three jobs to make ends meet deprives people of time for themselves, their family, and their community. Living paycheck to paycheck forces people to live in a short-term mindset, preventing the making of long-term plans that could improve their circumstances. By bolstering security, the nation can get closer to an economy in which Americans from all walks of life are free to reach their potential and pursue their dreams.

“How much amazing stuff are we missing from all the people who live in this country who could do anything if they weren’t just struggling to stay alive all the time? It’s utterly ridiculous. It’s a travesty. If they were put in a place where they weren’t pulling themselves up by their bootstraps all the time, what could they actually do for humanity? I think the potential is just unimaginable.”

— Alex, Administrative Assistant and Graduate Student, Montana

The following recommendations aim to remove obstacles that are currently preventing Americans from achieving security. Some of these recommendations are focused on solutions that will make it easier for people to meet their basic needs in areas like housing, health care, and childcare. Other recommendations in this section extend governmental protections for those who need extra help. In particular, we call for a more capacious view of social welfare programs, with the goal of providing not only a backstop against disaster but also an opportunity to advance. Together, the Commission’s proposals in this section will help more Americans experience security and the freedom and comfort that security provides.

Endnotes

- 36Franklin D. Roosevelt, “State of the Union Message to Congress: January 11, 1944,” Franklin D. Roosevelt Presidential Library and Museum (accessed July 26, 2023).

Recommendation 1

Redesign Safety Nets to Ensure Stability

Over the course of the Commission’s thirty-one listening sessions, participants from a wide range of backgrounds and many different parts of the country offered similar critiques of the design of social welfare programs. Though intended to protect people from hardship, these programs can be difficult to access, can fail to address the full scope of the problem they are trying to solve, or are designed in such a way that they actually create barriers to opportunities that could lead to mobility. Based on this insight and our research, the Commission has identified three specific ways that the design and administration of social safety nets could be reimagined.

Reduce Cliff Effects

Cliff effects arise from income eligibility cutoffs built into certain benefits programs. If household income rises above a certain threshold, the household becomes ineligible for specific programs or types of aid. This sudden loss of benefits forces households to scramble to replace vital assistance rather than to adapt in a sustainable way. Or recipients might strategically avoid earning higher wages in order to remain eligible, for example by splintering rather than pooling earnings. Cliff effects are prevalent in many federal, state, and local housing programs (rental assistance, vouchers, and eligibility for public housing), as well as childcare, health insurance, food assistance, and utility assistance programs. Because of the difficulty of phasing out health care benefits gradually, these types of programs offer particularly stark and sudden cliffs. In California, for example, an individual must make less than $47,520 a year to qualify for Medicaid. If they received a raise at work bringing their income even $1 above this threshold, they would lose their health care coverage, resulting in a net decrease in income.

“The system, as far as single moms with children, is designed to keep you there. If you make a penny over, they’re going to take away your SNAP benefits, your health insurance. However, that penny isn’t enough to cover the rest of the rent and the light bill. . . . If they would just have maybe a grace period . . . after getting a raise at work and the new job. And they don’t automatically say, ‘Oh, you [now] don’t qualify for childcare.’ So, then you have to start paying that immediately.”

— Kailin, Café Worker, Kentucky

Listen to this excerpt from our session with Kailin.

The Commission supports transforming a social insurance system with cliffs into one shaped like a gradual curve that eases people off via a scaled and appropriate gradient. We believe that no one receiving social welfare benefits should ever be made worse off as a result of earning an extra dollar. Households should be able to preserve their wage growth, and marginal earned income should never produce a net decrease in a person’s overall income. To help accomplish this, we recommend some combination of the following:

- Adopt a gradually phased-out benefits structure for key security programs like the Supplemental Nutrition Assistance Program (SNAP). Such gradients are already in place for the Earned Income Tax Credit (EITC). (For more on the model of the EITC, see Recommendation 12: Revise the Tax Code to Incentivize Work and End Tax Policies That Benefit the Wealthy.)

- Reimagine how family income is calculated. In particular, incorporate considerations of local costs of living and the full complement of the benefits and tax credits a household receives.

- Utilize or develop calculators to help recipients and caseworkers better identify benefit cliffs and develop training for caseworkers to help clients plan for the transition after they are no longer eligible for benefits.

- Revise asset limits and enact income disregards, which allow certain types or a certain percentage of household income to be excluded from standard calculations of household income.

Improve Information and Legal Assistance

Our listening sessions made clear that many Americans lack information about government benefit programs they are eligible for or how to secure legal assistance to access those benefits. The Commission hopes that a reimagined benefits system would be sufficiently user-friendly that legal assistance would not be required. Absent those reforms, the Commission offers two suggestions.

First, enable specialists to help Americans navigate government bureaucracies and court systems. These specialists might be lawyers, social workers, or other professionals trained to provide legal assistance. A recent study paired a group of Seattle-area housing voucher recipients with a nonprofit organization to help them conduct their housing searches, meet with landlords, and address short-term financial needs. Families paired with such navigators were more than three times more likely to move to a high-opportunity neighborhood than those who received no assistance, and they significantly outperformed families that only received some help.37 This research suggests that the nonprofit sector should scale up the use of navigators for housing and other types of government assistance, including consumer debt, health care, and veterans’ benefits. The Commission supports ongoing pilot programs in this area, including programs to provide navigators to households with medical and consumer debt.

Second, as detailed in the American Academy’s report Civil Justice for All, Americans are entitled to a lawyer in many criminal cases, but there is no such guarantee of a lawyer in civil matters, which encompass health, family, stability, financial security, and housing (for example, disputes between landlords and tenants).38 Current funding for the Legal Services Corporation, which supports the provision of civil legal aid, can address only 8 percent of the significant civil legal problems faced by low-income Americans.39 Nonprofit organizations seeking to aid lower-income Americans should finance the provision of legal services in civil justice matters, and state and federal governments should designate legal services as a valid use of funds for programs designed to aid lower-income people.40

An important way to help more Americans get the civil legal help they need is increasing the number of people allowed to provide this type of aid. In most states, lawyers are the only ones permitted to provide legal assistance. This state-sanctioned monopoly limits the supply of qualified aid providers, especially in rural areas. It also increases costs and stifles innovation, making private-sector legal assistance unattainable for many households. Utah, Arizona, Minnesota, Oregon, and California permit the use of nonlawyers for legal services in civil justice matters (though each state has adopted a slightly different model). The Commission encourages more states to expand the number and range of providers in the field of legal aid.41

Adopt a Place-Based Approach to Combat Concentrated Poverty

Many government programs and nonprofit efforts targeting poverty are focused on the household level. The Commission recognizes that these types of interventions alone are not enough. Many American communities need more holistic policies and programs to help them confront the problems created by long-standing patterns of disinvestment. In places where poverty has become concentrated, public schools and infrastructure have deteriorated, and elected officials have been unable or unwilling to confront the largest challenges, household remedies are not enough. Place-based policies that address a broader ecosystem of issues are essential.

One example of a place-based approach is the bipartisan 10–20–30 program, which directs at least 10 percent of funding from specific federal programs to the counties where 20 percent or more of the population has been living below the poverty line for the last thirty years. While the formula has been applied to certain federal rural, economic, and community development programs since 2009, it could be expanded to cover a wider range of federal programs.42 As of 2020, four hundred sixty counties in the United States have been designated as areas with “persistent poverty,” and the racial demographic breakdown of these counties in the aggregate is roughly in line with that of the nation as a whole. The 10–20–30 formula is race-neutral, then, while also providing an avenue for addressing racial disparities in federal funding.43 This program does not require additional federal funds, but instead makes existing investments more targeted to address the multiple ways in which concentrated poverty affects communities. Such a recalibration of funding priorities would represent a systemic approach to helping those areas of the country that have been left behind.

Endnotes

- 37Peter Bergman, Raj Chetty, Stefanie DeLuca, et al., “Creating Moves to Opportunity: Experimental Evidence on Barriers to Neighborhood Choice,” NBER Working Paper 26164 (Cambridge, Mass.: National Bureau of Economic Research, 2019; revised 2023).

- 38American Academy of Arts and Sciences, Civil Justice for All (Cambridge, Mass.: American Academy of Arts and Sciences, 2020).

- 39Legal Services Corporation, “The Justice Gap: The Unmet Civil Legal Needs of Low-Income Americans,” April 28, 2022.

- 40Karen A. Lash, “Executive Branch Support for Civil Legal Aid,” Dædalus 148 (1) (Winter 2019): 160–170.

- 41Michael Houlberg and Natalie Anne Knowlton, Allied Legal Professionals: A National Framework for Program Growth (Denver: Institute for the Advancement of the American Legal System, 2023).

- 42United States Government Accountability Office, “Areas with High Poverty: Changing How the 10–20–30 Funding Formula is Applied Could Increase Impact in Persistent-Poverty Counties,” May 27, 2021.

- 43Tracy Jan, “Reparations, Rebranded,” The Washington Post, February 24, 2020.

Recommendation 2

Adopt Inclusionary Zoning Policies to Increase the Housing Supply

The nation has an affordable housing crisis. Rising housing prices have increased rents and made homeownership an impossible dream for millions of Americans. More than nineteen million households were housing cost-burdened in 2021, meaning they spent more than 30 percent of their income on housing costs.44 In recent years, this crisis has expanded from the coasts into nearly every state. The lack of access to affordable homes is partly due to a historic housing shortage, as low supply and strong demand have caused prices to skyrocket. One 2022 study found that the United States is 3.8 million homes short of meeting its housing needs, a number that has doubled in the past ten years.45

The housing shortage affects Americans across the class spectrum, especially when it comes to buying a home. Homeownership has obvious financial benefits: it is the main way families build, maintain, and pass on wealth intergenerationally. Owning a home also creates rootedness and can help foster community involvement. The inability to achieve the milestone of homeownership, particularly among young Americans, can result in further disillusionment with the nation’s democratic and economic systems.46

One way to increase new home construction and make housing more affordable would be to amend restrictive zoning rules. Many areas, especially those with high job growth (such as Boston, Washington, D.C., and San Francisco), have used zoning and other regulations to limit new housing development. In particular, the widespread use of single-family zoning has severely restricted housing supply. According to The New York Times, 75 percent of residential land in American cities is limited to single-family homes.47 Exclusionary practices make it illegal for developers to build multifamily apartment complexes or smaller homes that would be more affordable. The net result is that many Americans—especially those in low-income and working-class households—cannot afford to live in the areas with the highest levels of economic and educational opportunity. And if they work in these areas, they cannot afford to live near where they work, resulting in long commutes, reducing their well-being, and exacerbating worker shortages. All of this reduces workers’ potential to secure a better life and diminishes overall economic growth.48

The Commission recommends that localities take two steps that would help address the supply-side causes of the housing affordability crisis:

- Reform single-family zoning ordinances, making it legal for developers to build multifamily housing units and for homeowners to build accessory dwelling units on their property.

- Pass inclusionary zoning ordinances. These ordinances could take a few different forms. One possibility is to create tax incentives for developers to build affordable housing units. Another is to mandate that new developments meet a minimum percentage of affordable units.

State-level policy has a large influence over whether localities can pass inclusionary zoning measures. Twenty-two states currently limit or prohibit inclusionary zoning at the local level.49

States could encourage zoning reform in local communities by changing these laws.

Case Study

Ending Exclusionary Zoning in Minneapolis, Minnesota

In late 2018, Minneapolis made history by abolishing single-family-home zoning city-wide. This move was striking for its broad approach. Other localities that have enacted zoning reform have done so incrementally. Portland, Oregon, New York City, and Arlington, Virginia, for example, liberalized zoning in certain neighborhoods but have not adopted wholesale changes throughout the city.

Until 2018, Minneapolis’s zoning restrictions set aside 70 percent of residential land for single-family homes. This exclusionary zoning was part of the reason for the city’s housing affordability crisis, with low supply and high demand causing housing prices to rise. With a city council vote, Minneapolis ended these restrictions, paving the way for the construction of duplexes and triplexes in areas traditionally reserved as single-family lots. City officials estimate that these changes will nearly triple the housing supply throughout Minneapolis.50

The elimination of single-family zoning is part of a comprehensive city plan, known as Minneapolis 2040, to create a more affordable, equitable, and economically dynamic city. The plan also includes an inclusionary zoning measure that requires 10 percent of newly developed units to be set aside for low- and moderate-income households.

How did Minneapolis overcome the political roadblocks that have impeded zoning reform in other American cities? Experts believe the accomplishment resulted from extensive democratic organizing and collaborations between advocates and local city officials. Organizers formed the group Neighbors for More Neighbors, which brought together civil and tenants’ rights groups, church and labor leaders, environmentalists, and senior citizens. Supporters of the Minneapolis 2040 plan, including Mayor Jacob Frey, also found creative platforms for community engagement. Traditionally, zoning hearings are dominated by affluent homeowners who oppose such changes. By seeking feedback in places like church and union meetings, advocates were able to garner support for zoning reform from a diverse set of audiences and increase political pressure. The 2040 plan passed with a nearly unanimous city council vote.

It will take time to adequately measure the effectiveness of zoning change in Minneapolis. However, the fact that such a sweeping measure was enacted in a major American city is worth observing and understanding. The succinct arguments given for ending exclusionary zoning, the broad coalition-building, and the creative approaches to public feedback are all steps that other localities can follow. Doing so will raise the likelihood of zoning reform measures being enacted across the country, a trend that is necessary to address the affordability housing crisis impacting millions of Americans.51

The Commission recommends that the federal government also aid in this effort through financial incentives. More federal funding for programs such as Community Development Block Grants can be awarded directly to localities that have adopted inclusive zoning regulations. Such funding can be withheld from communities that continue to enact exclusionary zoning. Ideas like these have received bipartisan support.52

Certain local communities have tried to enact zoning reform measures but have been thwarted by community members who benefit from the current system. To make zoning changes, most localities must solicit residents’ approval at community zoning hearings. The original impulse for creating such opportunities for public feedback came from a good place. In the mid-twentieth century, major projects like the construction of federal highways were undertaken without any community say and resulted in the displacement of community residents, many of whom were low-income and nonwhite. Today’s zoning hearings are the product of the reforms implemented to give community residents voice in what happens in their own neighborhoods. However, these public hearings have largely been co-opted by those who are already homeowners, many of whom tend to be white and well-resourced.53

Zoning proposals often spark such opposition because residents fear that new construction will reduce the value of the homes in their neighborhood. New Jersey provides evidence to counter these concerns. A Supreme Court of New Jersey ruling, Southern Burlington County NAACP v. Mount Laurel Township, prohibits exclusionary zoning and requires that all municipalities provide a “fair share” of affordable residences. This mandate has forced more than three hundred forty New Jersey towns to develop affordable housing units. Case studies of these communities have found that the construction of new housing units did not lower property values, nor did it result in rising crime or higher taxes. Mount Laurel provides a useful model, in particular, because of its effective countering of opposition to zoning changes. Under the court mandate, New Jersey residents must either consent to new housing development within their community or pay extra taxes for affordable units to be developed elsewhere. However, such court rulings cannot be ensured and may remain rare. Other areas, though, have initiated their own zoning changes without mandatory, court-ordered reforms. Minneapolis recently became the first major city to end single-family zoning through a comprehensive plan passed by the city council. Other states and localities should deploy similar methods to charge residents in communities with doing their part to address local housing needs.54

By passing inclusionary zoning policies, communities can make housing more affordable, improve the long-term financial stability of their residents, and do their part to address the nation’s critical housing shortage.

“I was able . . . in the 1980s to buy a first house on a modest income and start building security that way. But I fear I’m maybe the last one in my family to be able to do that for a while. My kids who are adults in their mid 20s are not able to buy homes right now even though they have good jobs and good partners. And so something’s got to happen with this economy that allows the next generation to continue to build security through homeownership.”

— Chris, Newspaper Editor, Montana

Endnotes

- 44Molly Cromwell, “Renters More Likely Than Homeowners to Spend More Than 30% of Income on Housing in Almost All Counties,” United States Census Bureau, December 8, 2022.

- 45Exceptions to this trend are communities that have been losing population (for example, Detroit and St. Louis). Such areas need maintenance and rehabilitation assistance housing programs to replace or fix homes that have become uninhabitable. Lucy Acquaye, “Low-Income Homeowners and the Challenges of Home Maintenance,” Community Development 42 (1) (2011): 16–33; Local Housing Solutions, “Homeowner Rehabilitation Assistance Programs,” NYU Furman Center’s Housing Solutions Lab (accessed July 26, 2023); Emily Badger and Eve Washington, “The Housing Shortage Isn’t Just a Coastal Crisis Anymore,” The New York Times, July 14, 2022; Ashfaq Khan, Christian E. Weller, Lily Roberts, and Michela Zonta, “The Rental Housing Crisis Is a Supply Problem That Needs Supply Solutions,” The Center for American Progress, August 22, 2022; Sam Khater, Len Kiefer, and Venkataramana Yanamandra, “Housing Supply: A Growing Deficit,” FreddieMac, May 7, 2021; and Mike Kingsella and Leah MacArthur, eds., 2022 Housing Underproduction in the U.S. (Washington, D.C.: Up For Growth, 2022).

- 46National Low Income Housing Coalition, “The Problem” (accessed July 28, 2023); Matthew Desmond, “Why Poverty Persists in America,” The New York Times Magazine, March 9, 2023; Lee Ohanian, “What Do Silicon Valley Tech Workers Earning $100,000 Call An Old Van? Home,” Hoover Institution, July 16, 2019; and Mike Baker, “A Town’s Housing Crisis Exposes a ‘House of Cards,’” The New York Times, July 31, 2022.

- 47Emily Badger and Quoctrung Bui, “Cities Start to Question an American Ideal: A House with a Yard on Every Lot,” The New York Times, June 18, 2019.

- 48Sarah Crump, Trevor Mattos, Jenny Schuetz, and Luc Schuster, “Fixing Greater Boston’s Housing Crisis Starts with Legalizing Apartments Near Transit,” The Brookings Institution, October 14, 2020; Vanessa Brown Calder, “Zoning, Land‐Use Planning, and Housing Affordability,” Policy Analysis No. 823 (Washington, D.C.: Cato Institute, 2017); M. Nolan Gray, “Cancel Zoning,” The Atlantic, June 21, 2022; Badger and Bui, “Cities Start to Question an American Ideal”; and Chang-Tai Hsieh and Enrico Moretti, “Housing Constraints and Spatial Misallocationv,” American Economic Journal: Macroeconomics 11 (2) (2019): 1–39.

- 49Domenick Lasorsa, “Does Your City Have Access to Inclusionary Housing,” National League of Cities, May 9, 2019.

- 50Jenny Scheutz, “Minneapolis 2040: The Most Wonderful Plan of the Year,” The Brookings Institution, December 12, 2018.

- 51Sarah Mervosh, “Minneapolis, Tackling Housing Crisis and Inequity, Votes to End Single-Family Zoning,” The New York Times, December 13, 2018; Richard D. Kahlenberg, “How Minneapolis Ended Single-Family Zoning,” The Century Foundation, October 24, 2019; Scheutz, “Minneapolis 2040”; and Ron J. Feldman, Kim-Eng Ky, Ryan Nunn, et al., “New Fed Tool Will Measure Zoning Reforms’ Impacts on Housing Affordability in Minneapolis,” Federal Reserve Bank of Minneapolis, November 30, 2021.

- 52Yes in My Backyard Act of 2021, S. 1614, 117th Cong. (2021); and Jenny Schuetz, “Dysfunctional Policies Have Broken America’s Housing Supply Chain,” The Brookings Institution, February 22, 2022.

- 53Jerusalem Demsas, “Community Input Is Bad, Actually,” The Atlantic, April 22, 2022.

- 54Len Albright, Elizabeth S. Derickson, and Douglas S. Massey, “Do Affordable Housing Projects Harm Suburban Communities? Crime, Property Values, and Taxes in Mount Laurel, NJ,” City Community 12 (2) (2013): 89–112; and Sarah Mervosh, “Minneapolis, Tackling Housing Crisis and Inequity, Votes to End Single-Family Zoning,” The New York Times, December 13, 2018.

Recommendation 3

Reform Childcare and Health Care to Lower Costs and Facilitate Benefit Portability

In the Commission’s listening sessions, the Americans we spoke with yearned for the ability to bear ordinary risks and shocks—to have a cushion in case of illness or accident. Many participants identified the lack of affordable childcare and health care as causes of this insecurity. The sense of uncertainty that comes with living one medical bill away from financial hardship can forestall hopes for a better future. Americans should be able to take care of their mental and physical health without fear of financial catastrophe. And decisions about having children should not be dominated by concerns about the cost of childcare.

Health insurance and childcare can also serve as barriers to opportunity. The United States’ unique reliance on employers to provide health insurance means that job opportunities and health coverage are closely linked. Workers may fear losing benefits if they change jobs. They may also be averse to incurring the costs associated with changing health care providers that might come with changing health plans. And workers may not enter the labor force at all if they cannot receive work supports like health insurance and childcare—especially if they risk losing access to public benefits in doing so. Moreover, independent contractors and self-employed workers often go without benefits. This strengthens the case for greater provision of portable benefits that are within the means of workers.

The challenges Americans face in getting affordable health care and childcare can have damaging individual and societal consequences. Someone who receives a surprise medical bill for a procedure they were told would be covered by insurance, or someone who wants to take a better job but cannot afford to do so out of fear of disrupting their childcare arrangement, might understandably mistrust market or political institutions. Access to basic health care and childcare represents a seemingly fundamental component of the social contract, one that many Americans believe to be broken. In 2021, three-quarters of Americans said the nation’s health care system needs either “major” changes or needs to be “completely reformed.”55

“You can economize, but you really can’t control what happens to you if there’s a medical expense. So that uncertainty really affects your well-being, it affects what you do, it affects how you behave.”

— Shambu, Airport Worker and Tutor, Virginia

Listen to this excerpt from our session with Shambu.

Health Care

The Commission has identified several principles that should guide public policy on health care. We arrived at these principles based on the concerns described above and our awareness of the changing relationship between health care and employment.

Over the last few decades, health care reformers have led a movement to decouple health care benefits from employment. This effort responds to both the decline of employer-sponsored coverage over the past generation and the expansion of alternative sources of coverage (especially the Medicaid and Affordable Care Act marketplaces). But despite major changes to U.S. health care policy, significant challenges remain: the United States is still too far from universal coverage, the costs of health care have steadily risen and are projected to increase sharply, and there is growing concern about the quality of future care and about the nation’s ability to remain a health care innovator.

The Commission suggests the following principles to guide the nation to better health care policy:

- Encourage new options for coverage that do not run through employers. These could include Medicaid (which is often run through private plans), new “public options” such as federal Medicare or state-level buy-in programs, and mutual benefit associations such as freelancers’ benefits.

- Create opportunities for employers to contribute to the cost of such options without sponsoring benefits directly. This would allow health care to remain a part of employers’ recruitment and retention efforts, without creating the risk and immobility for workers that result when benefits are closely tied to a particular job. Such an arrangement would also prevent employers from using benefits programs to determine employee access to procedures, prescriptions, and other forms of medical care.

- Reduce subsidies of employer-provided health insurance, particularly for high-income households, relative to portable benefit options (see Recommendation 12: Revise the Tax Code to Incentivize Work and End Tax Policies That Benefit the Wealthy).

- Reduce health care costs in a way that both protects the quality of care and allows for continued improvements in the quality of care. Means toward this end could include pushing back against industry consolidation at the state and national levels (see Recommendation 11: Deconcentrate Economic Power), as well as a greater emphasis on a combination of private incentives with government regulation. An especially important approach is regulation requiring more meaningful price transparency as a means of disciplining cost growth. Lighter regulation on some components of insurance plans and an increase in the use of high-deductible plans and health savings accounts—consistent with risk-sharing and adequate financial protection—could also lead to more innovative insurance designs and lower costs.

Childcare

Affordable, accessible childcare is vital for parents’ consistent labor market participation, particularly mothers’. From February 2020 to January 2022, nearly two million women left the workforce, many to assume childcare responsibilities during the pandemic.56

To ensure access to affordable childcare, we propose a mix of providers and services. For noninfant children (that is, preschool and older), broadening the reach of public education and ensuring after-school alternatives would build on existing institutions to provide important assistance to families. For younger children, however, some mix of expanded public benefits and subsidies and encouragement of increases in the supply of high-quality affordable care will be necessary. Such policies should also aim to remedy the shortage of childcare workers, which appears to be due at least in part to the low pay of these positions (less than half of the national median income in 2022).57 Because many low-income parents work on evenings and weekends, policies to increase access to childcare cannot solely rely on the commercial sector and must recognize that many parents use informal care networks. The fundamental principle is that parents should not be so burdened by childcare costs that they do not feel they have the opportunity to combine paid employment and child-raising.

“I feel like as a single mom . . . paying for childcare pretty much defeats the purpose of going to work.”

— Anonymous, Kentucky

Endnotes

- 55Richard Wike, Janell Fetterolf, Shannon Schumacher, and J. J. Moncus, “Citizens in Advanced Economies Want Significant Changes to Their Political Systems,” Pew Research Center, October 21, 2021.

- 56Jasmine Tucker and Brooke LePage, “Men Have Now Recouped Their Pandemic-Related Labor Force Losses While Women Lag Behind,” National Women’s Law Center, February 8, 2022.

- 57U.S. Bureau of Labor Statistics, “May 2022 National Occupational Employment and Wage Estimates,” (last modified April 25, 2023).

Recommendation 4

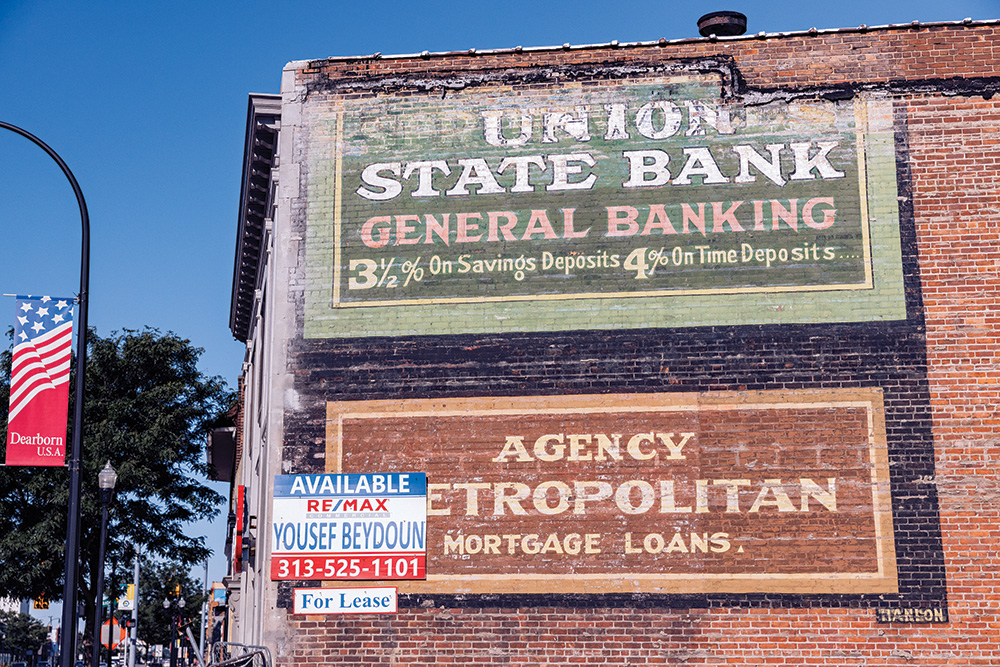

Expand Access to Low-Cost Banking for Low-Income Americans

Access to secure and affordable banking services is fundamental for economic well-being in the twenty-first-century United States. Banks ensure that people receive the full amount they are owed from their paychecks and provide regulated home and small-business lending. As important, the ability to save and build wealth confidently fosters trust in the financial system.

For millions of Americans, traditional banking options remain inaccessible. The latest Federal Deposit Insurance Corporation (FDIC) national survey found that approximately 5.9 million households were unbanked. Another 18.7 million households were underbanked or used nontraditional banking methods. Unbanked and underbanked rates are higher among low-income and minority households.58

Surveys reveal that the main reasons the unbanked and underbanked give for not having a bank account involve affordability and trust. Many unbanked and underbanked people do not perceive banks as trustworthy institutions. These misgivings arise in part from a history of discriminatory practices and policies within the financial services industry. From historical redlining to current experiences with racial profiling, discriminatory measures have eroded faith in the banking system in minority communities. Structural barriers within the system have also disproportionately affected low-income Americans of all races. Most major commercial banks require minimum balances to open an account. Large banks also charge high, automatic fees to those who overextend their deposits. These measures effectively keep poor Americans from using mainstream banking services or make it expensive or difficult for them to do so.

Geography plays a major role in determining banking access. Since the Great Recession of 2008, over thirteen thousand local bank branches have closed. This trend is in part due to consolidations and mergers in the banking industry. In the aftermath of the Great Recession, big banks came to dominate the financial market. They acquired smaller banks and removed branches from local communities.59 Across the country, twenty-six counties have no banks, and six hundred counties have no local banks. For communities in rural America or Indian Country that already had few physical bank locations, these closures have created banking deserts. The absence of bank branches makes it more difficult for people to get basic financial services. While digital banking options and mobile app services like Venmo and Cash App have greatly expanded in recent years, studies show that brick-and-mortar bank branches remain essential in areas where many people lack financial resources and internet access.60

In the absence of traditional banks, Americans often turn to more expensive and less regulated options, such as check-cashing stores or payday lenders. Low-income Americans pay almost $10 billion in check-cashing and payday-loan fees every year. The high fees and interest rates of these banking alternatives have damaging financial consequences, inhibiting customers from building credit and from being able to set aside savings for emergencies. To tamp down on these predatory financial schemes, states should mandate transparency from lending institutions by requiring them to publish the average costs of different loans. Credit card lenders, too, should be required to post the information customers need to make informed decisions about borrowing.

The Commission recommends other measures so that low-income Americans would not need to turn to alternative lending institutions in the first place. Commercial banks should be required to offer low-cost bank accounts, which would provide more Americans with affordable banking options. Traditionally, mainstream banks have not been incentivized to attract low-income customers, since they are not seen as profitable. If banks are unwilling to serve these customers, government could consider modest credits to encourage them to do so.

Changing federal regulations to enable and encourage commercial banks to offer small credit sums, repayable in installments, would also allow Americans to obtain necessary short-term loans through traditional banking services. Additionally, just as navigators have proven to be effective at connecting Americans with benefit programs (see Recommendation 1: Redesign Safety Nets to Ensure Stability), similar assistance can be used to help individuals navigate different banking options and provide mechanisms to foster financial literacy. Connecting navigators with unbanked and underbanked populations would not only help to improve financial health within underserved communities but would also create more trust in the banking system.61

One of the most promising ways to create a more inclusive banking environment is to increase the number of community financial institutions. Community Development Financial Institutions (CDFIs), Minority Depository Institutions (MDIs), and local credit unions have proved effective at reaching unbanked populations. MDIs and CDFIs are often mission-driven, designed to reach minority and low-income communities left out by the traditional banking industry. Because of this mission, community banks can overcome trust barriers and customize their services to meet the needs of their clients. MDIs have been able to increase credit access in majority Black neighborhoods, providing clients with deposit services as well as residential mortgage and business loans. CDFIs have increased financial health in Indian Country, and one recent report found that credit scores are higher for Native Americans in areas with CDFIs.62

“I’m 34 and I’m just now learning about credit about two years ago. . . . We need to be taught how to do things, like open up a bank account [and the] basic essentials to set us up for a better future for ourselves and our children. Because a lot of people don’t even know how to open up a bank account. They think that they can’t.”

— Whitney, Waitress and Cosmetologist, Kentucky

CDFIs and regional development banks are also beneficial for small businesses. In banking deserts, it is difficult for small businesses to access credit, and they often have to turn to higher-cost private credit options. CDFIs help connect small businesses with more affordable credit choices and allow them to maintain or expand their operations in local communities.63

There are currently 146 MDIs that reach six hundred majority-minority communities nationwide and three hundred CDFIs that serve primarily low-income markets. The Commission recommends expanding the number of MDIs and CDFIs throughout the country. This expansion will require increased funding and investment, as well as changes in banking regulations. Current federal rules prevent community banks from accessing the public capital markets that larger banks use. Easing these regulations would facilitate the expansion of the institutions that best serve people not being reached by commercial banks. Funding and promoting community banking services will stimulate business growth in underserved areas and increase the financial health of low-income and minority Americans.64

Endnotes

- 58Tony Cookson, “Growing Up in a Banking Desert Can Hurt Your Credit for the Rest of Your Life,” The Conversation, February 19, 2020; and Federal Deposit Insurance Corporation, “National Survey of Unbanked and Underbanked Households: Executive Summary,” (last modified July 24, 2023).

- 59Jad Edlebi, Bruce C. Mitchell, and Jason Richardson, The Great Consolidation of Banks and Acceleration of Branch Closures Across America: Branch Closure Rate Doubled During the Pandemic (Washington, D.C.: National Community Reinvestment Coalition, 2022).

- 60Services like Venmo and Cash App provide vehicles for direct deposits and money exchanges. In 2022, Cash App had 80 million active users and 1.5 million users with active direct deposits. Brian Grassadonia, “Block Investor Day 2022: Cash App” (accessed August 2, 2023); Jad Edlebi, Bank Branch Closure Update (2017–2020) (Washington, D.C.: National Community Reinvestment Coalition, 2020); Melissa Hellmann, “Bank Branch Closure Rate Doubled During Pandemic,” The Center for Public Integrity, February 17, 2022; and Consumer Financial Protection Bureau, “Challenges in Rural Banking Access,” April 19, 2022.

- 61American Bankers Association, “Nichols Urges All Banks to Offer On-Certified Accounts,” ABA Banking Journal 113 (1) (2021): 9; and Frederick Wherry, “Payday Loans Cost the Poor Billions, and There’s an Easy Fix,” The New York Times, October 29, 2015.

- 62Kristen Broady, Mac McComas, and Amine Quazad, “An Analysis of Financial Institutions in Black-Majority Communities: Black Borrowers and Depositors Face Considerable Challenges in Accessing Banking Services,” The Brookings Institution, November 2, 2021; and Valentina Dimitrova-Grajzl, Peter Grajzl, Joseph Guse, et al., “Native CDFIs Bring Holistic Approach to Assessing Credit Risk,” Federal Reserve Bank of Minneapolis, February 2, 2023.

- 63Steve Maas, “Small Business Lending Declined after Dodd-Frank Passed,” The NBER Digest 6 (2018).

- 64Kelly Pike, “How Community Banks Are Reaching the Unbanked,” Independent Banker, May 1, 2020; and Independent Community Bankers of America, “The Critical Role of CDFIs and MDIs in Underserved Communities,” February 9, 2022.